The Printed Circuit Board is the Weakest Link in the European and American Supply Chain

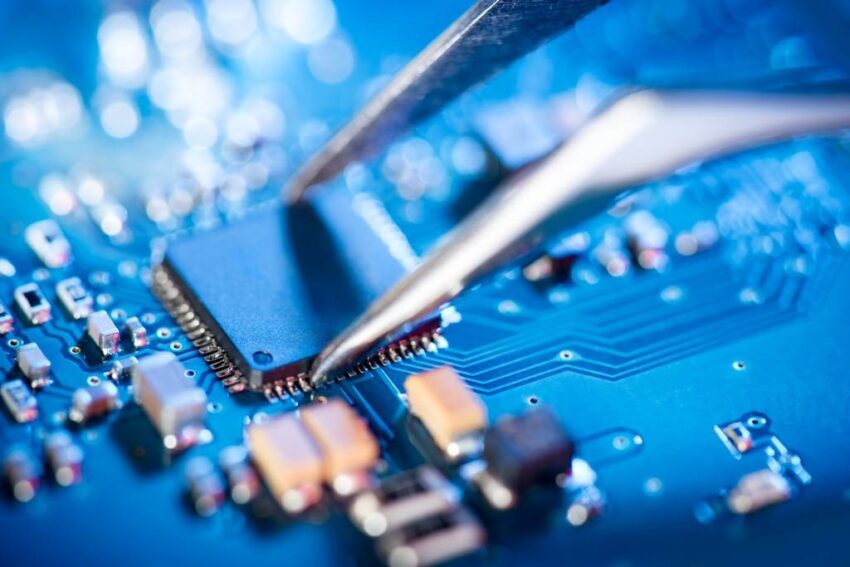

The printed circuit board (PCB) serves as the central nervous system for electronics, channeling power and data flows that enable devices to function. However, even as chips and components rapidly advance, the PCB supply chain remains stalled in antiquated infrastructure.

In Europe and America, where less than 10% of boards are produced, this stagnation threatens to stall innovation and distribution. Revitalizing the PCB ecosystem requires confronting difficult realities – from dwindling domestic manufacturing to overreliance on Asia.

PCBs and Semiconductors

PCBs are the platforms onto which semiconductors and other components are mounted. They contain the conductive tracks, pads and interconnects that route power and signals between parts. PCB fabrication involves complex processes like laminating, etching, drilling and plating to produce multilayer boards.

The performance of PCBs directly impacts electronic products. More layers and higher densities enable faster speeds and greater functionality. PCB design and semiconductor integration are co-dependent; you need capable PCBs to utilize cutting-edge chips.

While semiconductors get more focus, PCB technology is just as critical. The PCB supply chain must keep pace to fully leverage advances in semiconductors.

Fragility in Europe and America

Currently, the European and American PCB supply chains are fragile. In 2021, over 90% of PCB production occurred in Asia, with China accounting for over 50% of global output. There is very little PCB manufacturing onshore in Europe and America.

Many factors drive this imbalance. PCB fabrication involves economies of scale. Production volumes in Europe and America are a fraction of those in Asia. High labor and regulatory and environmental costs also make domestic production expensive. This has led to offshoring of manufacturing to low-cost regions.

Reliance on Asia creates strategic vulnerabilities. Geopolitical tensions, pandemics, accidents and natural disasters could suddenly cripple supply. Shipping and port congestion also pose challenges, as PCBs are bulky products.

While governments provide some incentives for domestic PCB production, building capacity takes years due to technical barriers. Nearshoring production in Mexico helps but is still exposed to external risks.

WIN SOURCE is a global electronic components distributor with an extensive PCB product line that provides flexible logistics and sourcing options to customers worldwide. With over 23 years of experience, WIN SOURCE offers one-stop procurement, eliminating the need to compare and browse multiple channels. Its extensive network ensures timely delivery of quality components backed by a three-year warranty.

Importance of Supply Resilience

A resilient PCB supply chain is crucial for European and American technology leadership. PCBs are integral to product lifecycles, so shortages hamper R&D and manufacturing. Aerospace, defense, computing, 5G and EVs all depend on access to the latest PCBs.

Delays or price spikes have cascading effects across supply networks, increasing costs and delivery times. This makes industries less competitive and hinders bringing innovations to market. Having diverse PCB sources provides a buffer against disruptions. But currently, options are limited and qualified suppliers are overloaded with demand. Strategic stockpiling helps but ties up working capital.

Investments must be made to develop advanced domestic PCB capabilities and competent suppliers. This will involve public-private partnerships, funding R&D and developing skilled workforces and production infrastructure. The PCB supply chain cannot improve overnight, but concrete steps can steadily reduce vulnerabilities. The payoff will be more resilient next-generation technologies that ensure economic and defense leadership.

Steps to Bolster the PCB Supply Chain

To strengthen PCB supply chain security and resilience, Europe and America should undertake focused efforts, such as:

- Providing financial incentives for capital investment, R&D and workforce training to significantly boost domestic PCB fabrication capabilities and capacity. This builds technical expertise.

- Securing access to vital raw materials like laminates, prepregs and copper foils through trade partnerships with suppliers in nations like Japan, South Korea and Germany.

- Investing in university and vocational programs to develop a skilled domestic workforce of PCB engineers, designers and technicians.

- Fostering closer partnerships between PCB manufacturers, electronics designers and electronics production firms to improve flexibility.

- Maintaining reserves and stockpiles of key PCB materials to weather supply shocks.

- Diversifying suppliers across multiple global regions to mitigate geography-specific risks.

- Providing tax benefits and grants for new domestic PCB fabrication facilities and expansion of existing facilities.

- Funding industry associations to develop PCB standards and best practices.

While progress will require sustained long-term efforts, focused steps to rebuild domestic PCB manufacturing ecosystems and strategically manage the global supply chain will strengthen the electronics industries vital to European and American economic prosperity and national security. With the electronics sector playing an ever-greater role across the defense, aerospace, telecommunications, computing and medical fields, securing the PCB supply chain is crucial.